Open a deposit account

via  It’s easy and convenient!

It’s easy and convenient!

No minimum opening balance, no documentation required.

No passbook require to initiate transactions.

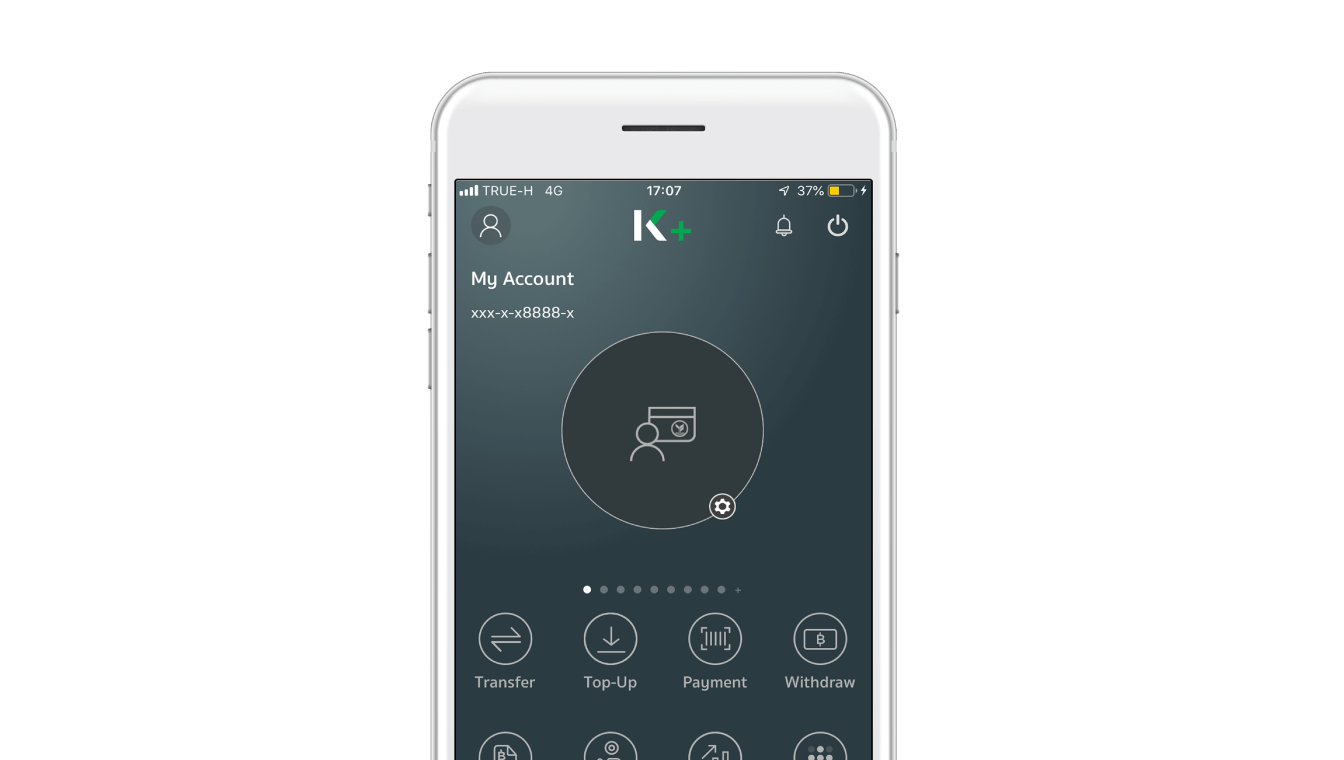

Transfer funds, top-up, pay bills, apply for a debit card and purchase mutual funds and travel insurance via K PLUS.

Free monthly K-eMail Statement. Statements covering up to the past 12 months could be requested via K PLUS.

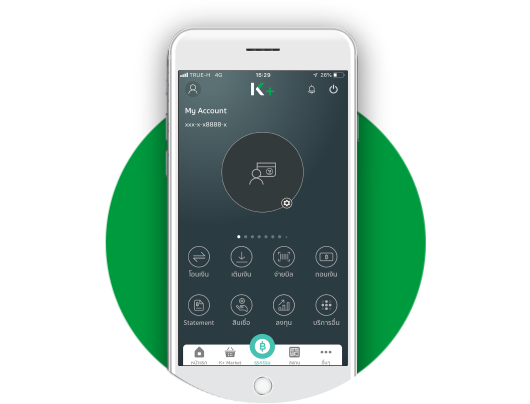

Open an account via

and start using

it now! Follow these five steps:

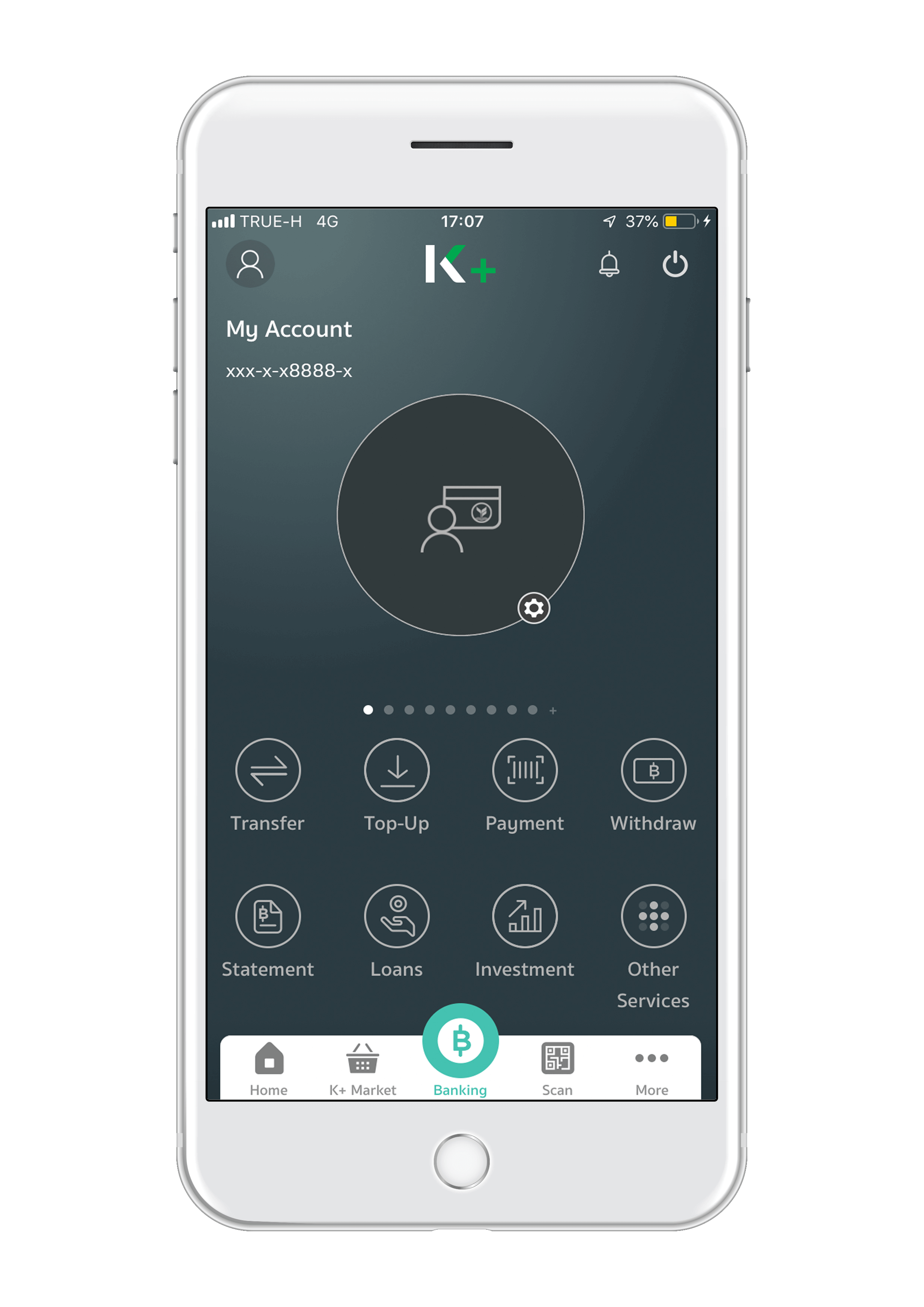

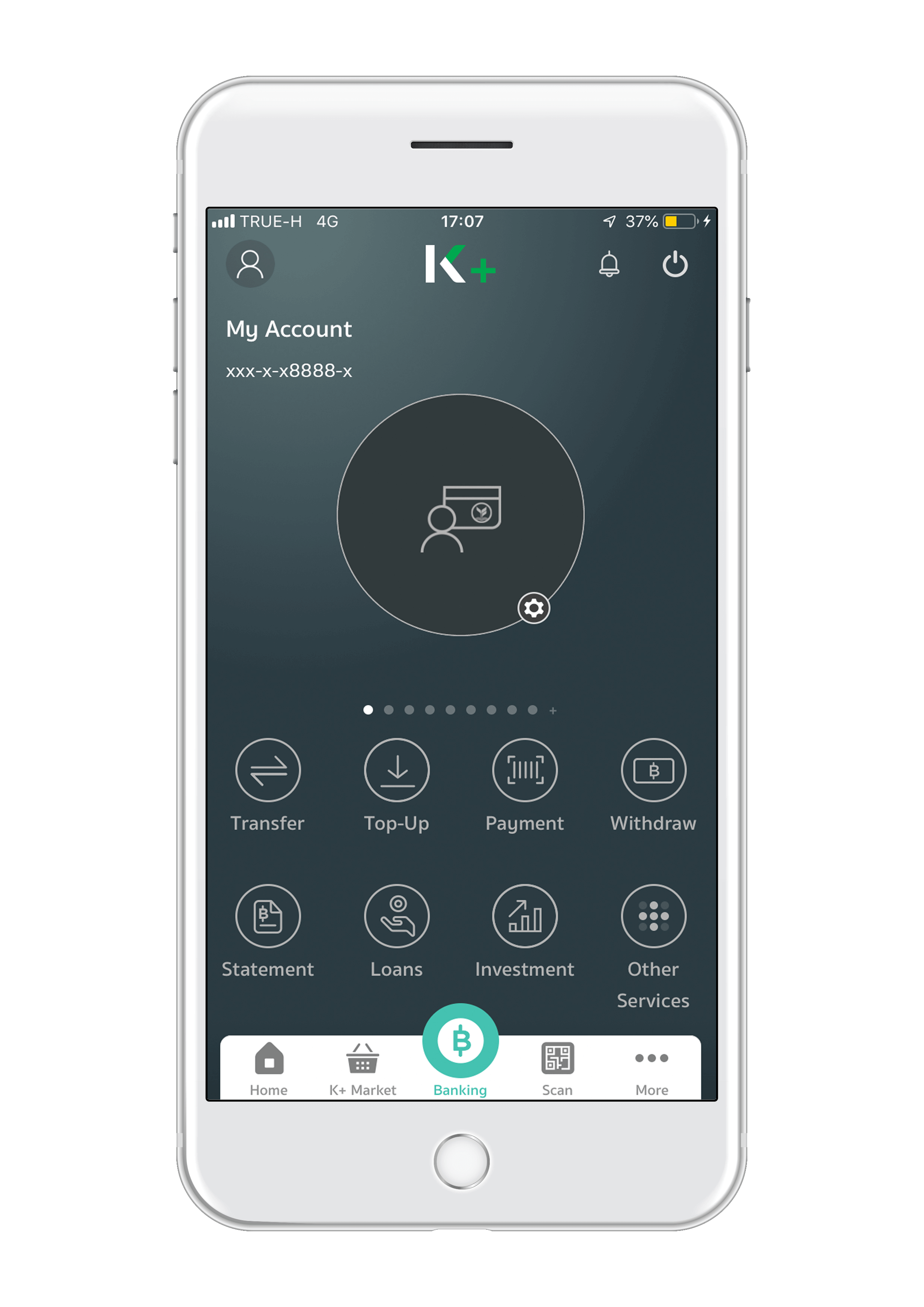

Open and log in to K PLUS and choose "Services"

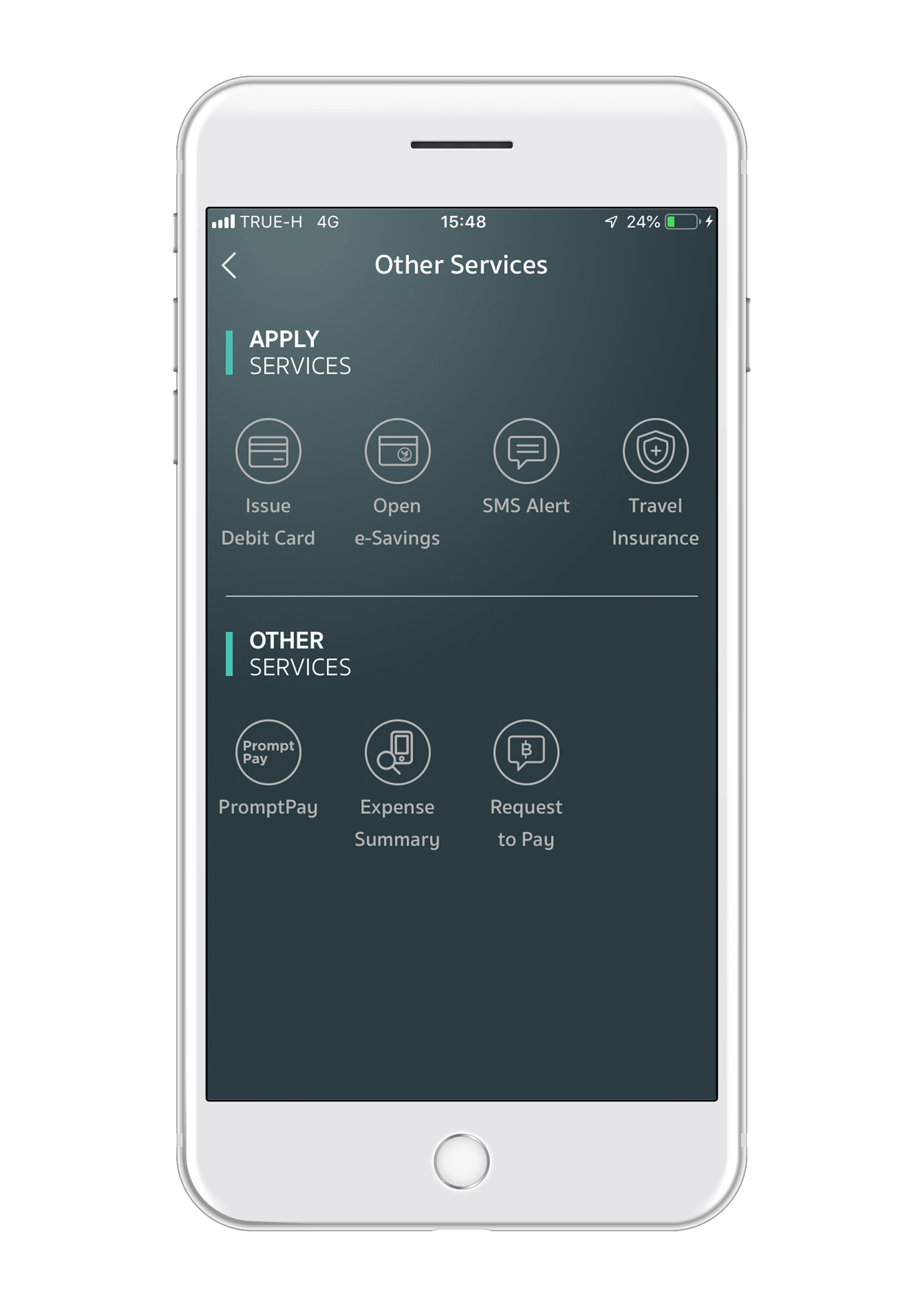

Choose "Open K-eAccount" and select "Open Account"

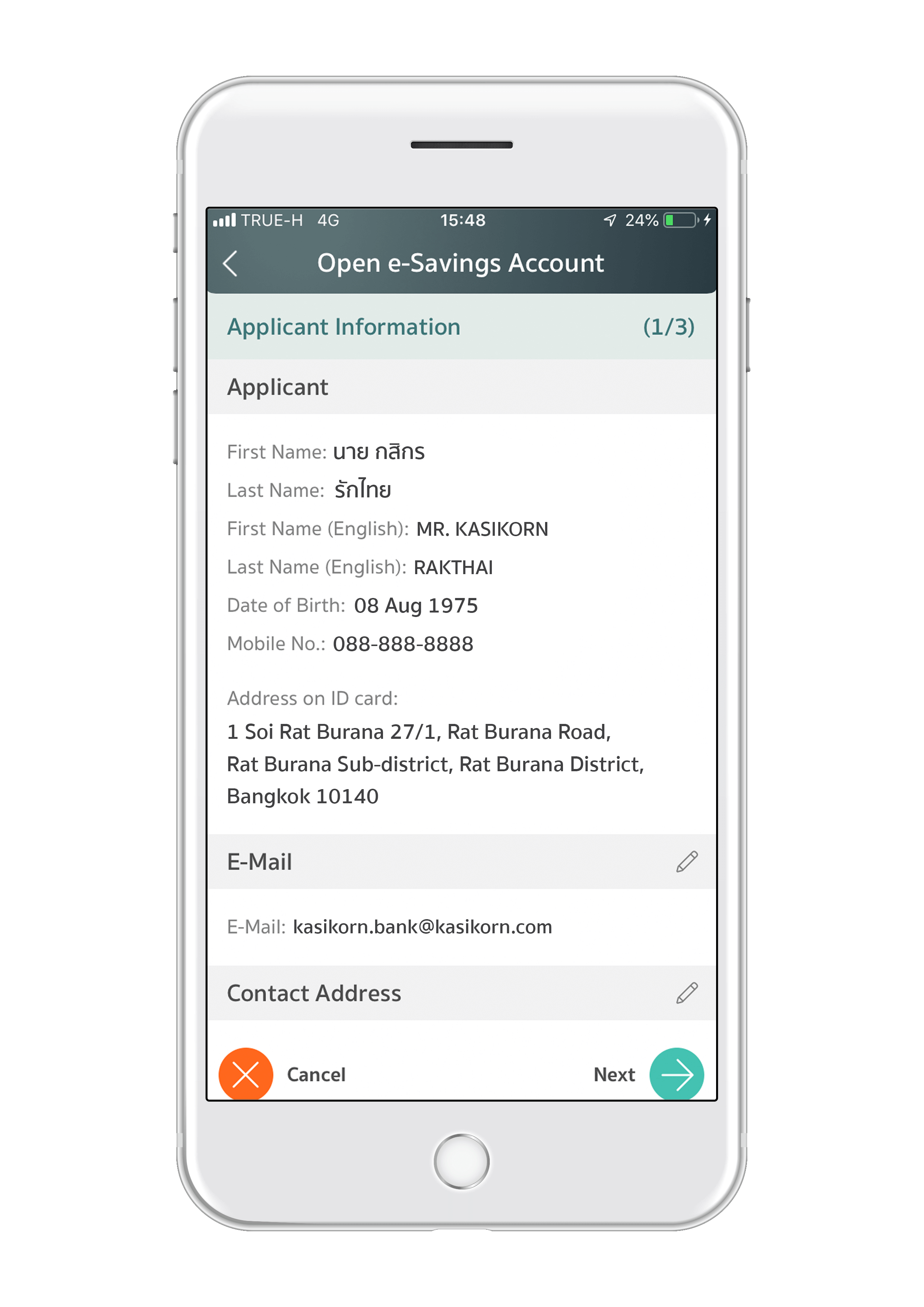

Read terms and conditions and enter requested information in full and select "Next"

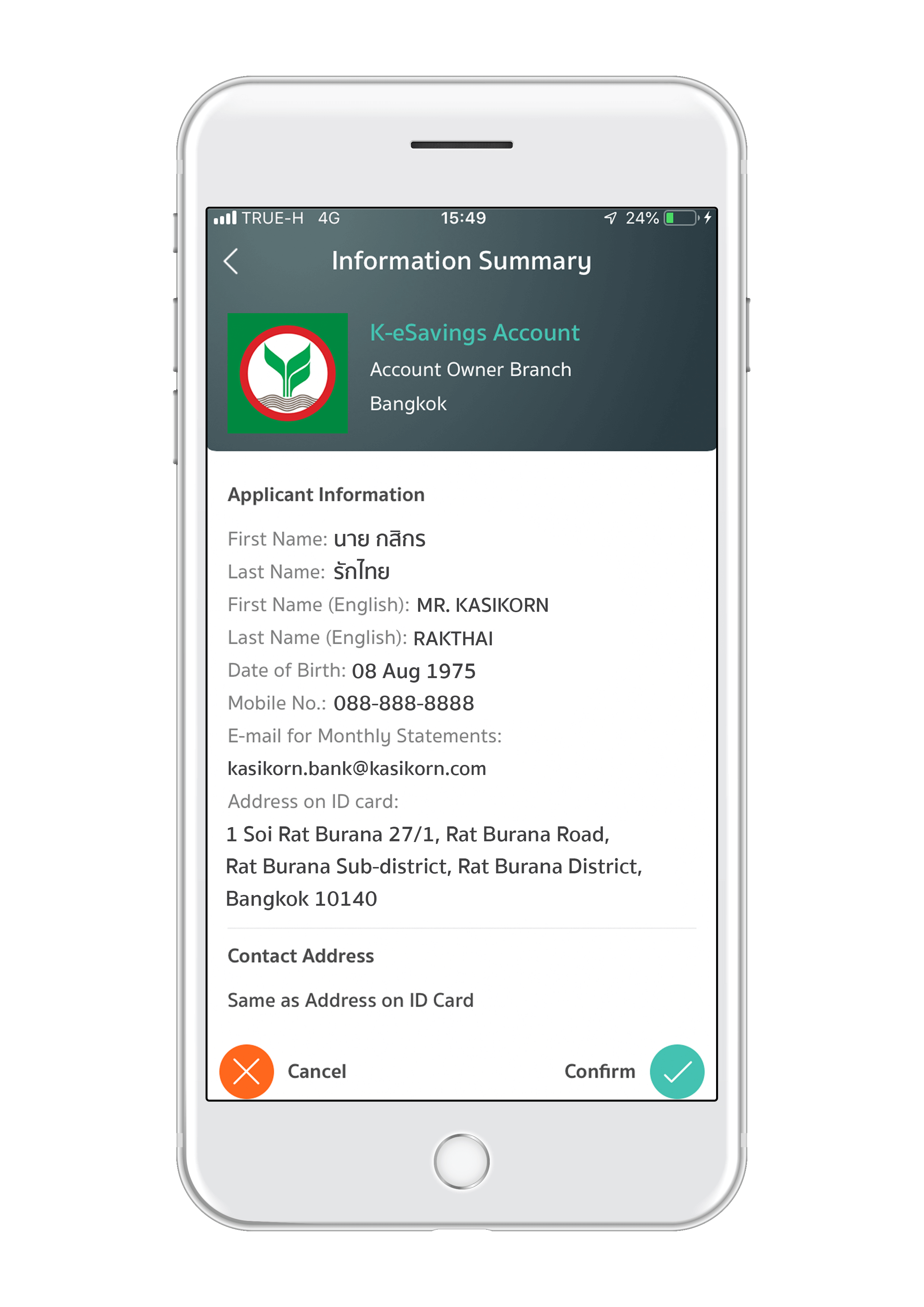

Review entered information. When correct, choose "Confirm"

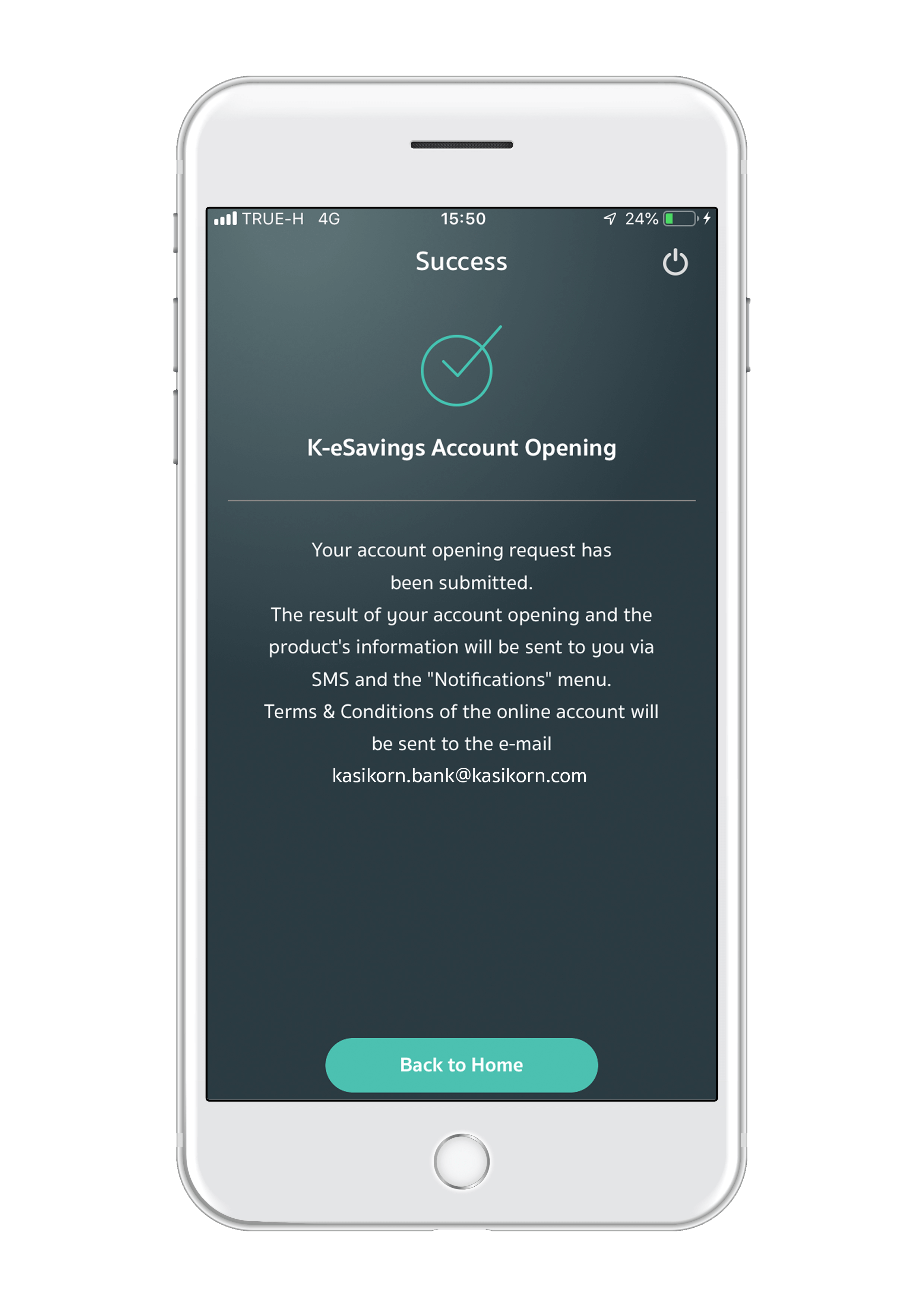

Your account is now open and ready for use! You will receive account details via Life PLUS, SMS and at the email address registerd with the Bank

Never used K PLUS? If you have a KBank account, just download the K PLUS application... Get started!

Transaction channels

K PLUS Application K PLUS Application

|

Branch Branch

|

ATM ATM

|

K-Contact Center K-Contact Center

|

|

| Deposit | ||||

| Withdraw | ||||

| Transfer / Top up / Pay bills | ||||

| Request Statement | ||||

| Apply for SMS Alert | ||||

| Apply for PromptPay | ||||

| Apply for Debit Card | ||||

| Buy travel insurance | ||||

| Buy mutual funds | ||||

| Close account |

Note: Transaction limits for each channel are designated by KBank.

Frequently Asked Questions

Highlights of “K-eSavings Account”

- Convenience : The account can be opened from 12 years old without any account need to be opened with the bank before, more convenient with an online passbook on K PLUS.

- Security : The online deposit account opens by yourself via K PLUS which is highly secure application. Verifying your identity with national ID card at a K CHECK ID service point (or an NDID service).

- Free of charge : Open an account with 0-baht, money transfer / top-up / bill payment / receive money from e-wallet and request e-statement via K PLUS.

How to open a K-eSavings account ?

- For customers who already have K PLUS : The account can be opened through K PLUS only 1 account by depositor without any required service at branch. Once the account is successfully opened, it can be used immediately. Transactions, including opening to closing the account.

- For new customers: You can download the K PLUS application and fill out the information anytime, anywhere and bring your ID card to verify your identity at a K CHECK ID service point or through the NDID platform. Once the account is successfully opened, it can be used immediately.

Yes. K-eSavings Account interest in excess of 20,000 Baht a year is subject to the 15% withholding tax.

The identity verification service for account opening example K-ATM, bank branch, Big C, Mini Big C, 7-Eleven. Please find the nearest K Check ID location at (Link)

You can view / download passbook via K PLUS. Go to “Settings” and select “Virtual Passbook”

You can close the account only via K PLUS. Go to “Settings” and select “Close Account”.

An account maintenance fee of 50 Baht will be assessed each month that account has been inactive for over 12 consecutive months and the balance is under 2,000 Baht.

No. Joint K-eSavings Accounts are not available.