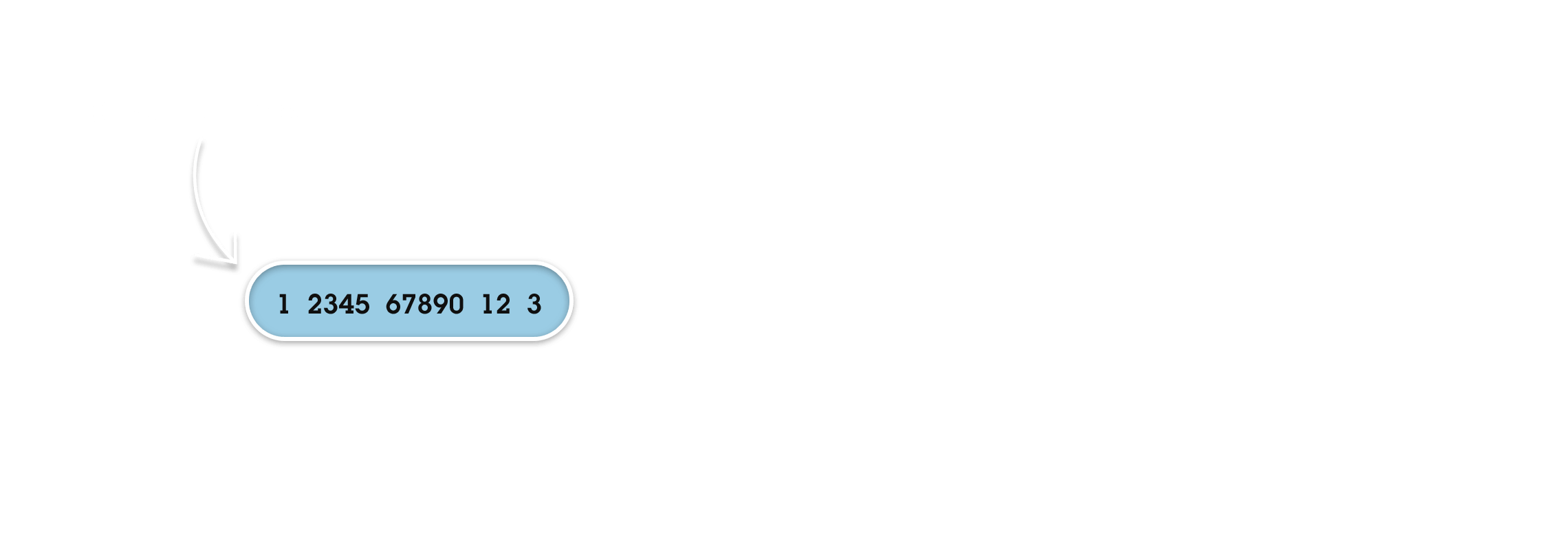

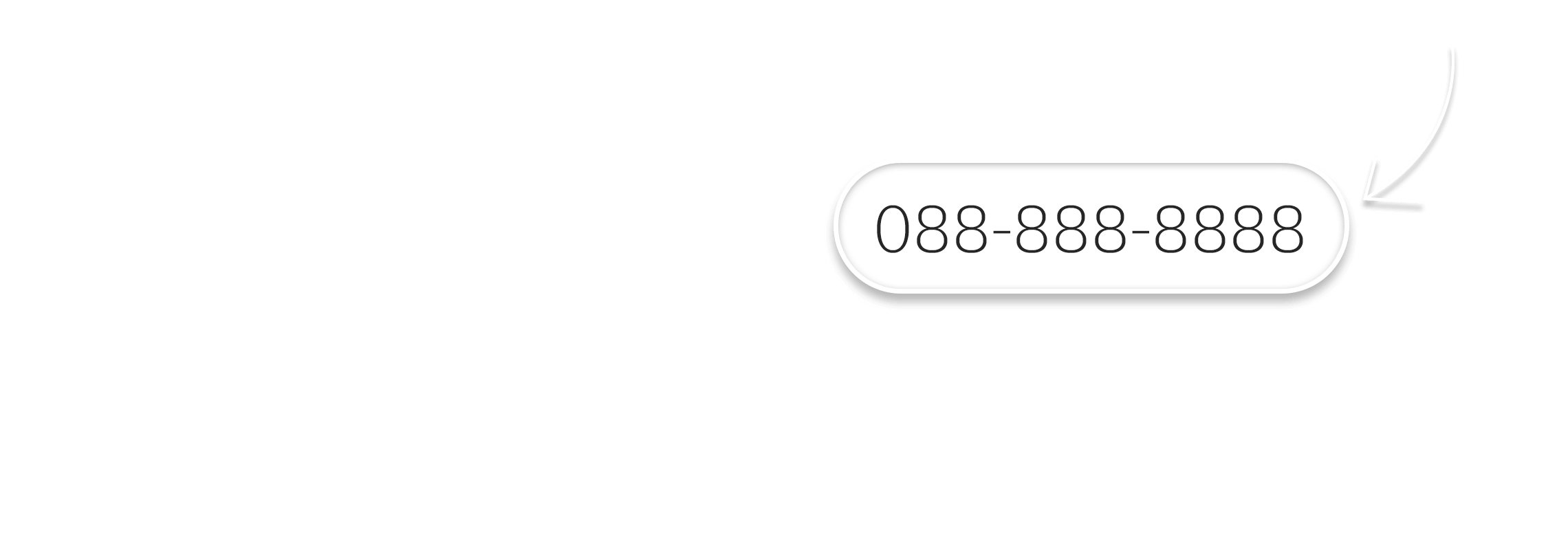

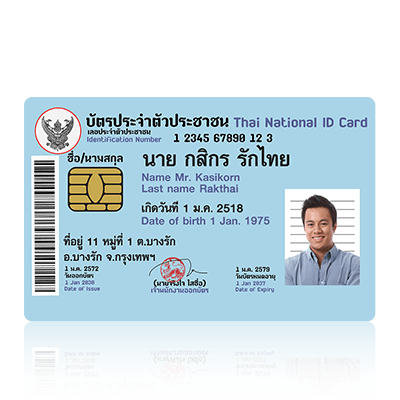

Use only your Citizen ID number or Mobile phone number to link with your bank account.

Use your citizen ID to receive payments from government agencies.

No need to remember account number. Use only mobile number to receive money.

Secure Reduce risk

from carrying cash.

Select your main bank account, either saving or current account. Maximum 4 accounts can be linked.

Each citizen ID number can be linked to only one deposit account.

Each number can be linked to only one deposit account and maximum 3 numbers can be linked.

Note: It can’t be linked with another account until you unregistered your current PromptPay account.

There is no fee for PromptPay registration.

Customer needs to register PromptPay in order to receive money via PromptPay. On the contrary, customer who wants to transfer money via PromptPay, does not need to register PromptPay.

The citizen ID number or mobile phone number can be linked with only one bank account at a time.

No, they could not because making fund transfer from one’s account needs confidential information such as PIN number or password to log in. Having citizen ID number or mobile phone number only could not make fund transfer.

Once the transaction has been made; the bank cannot reverse it from its end without approval from the beneficiary. Bank cans only act as a facilitator. Therefore, the customer has to gather all proof regarding that fund transfer and contact customer’s bank immediately. As for KBank, the customer can contact K-Contact Center 02-8888888

KBank customers can cancel PromptPay registration via K-Mobile Banking PLUS, K-ATM and K-Contact Center 02-8888888

| Transfer amount | Fee per transaction |

| Transfer via ATM | |

| Not over 5,000 Baht | No fee |

| More than 5,000 – 30,000 Baht | 2 Baht |

| More than 30,000 – 100,000 Baht | 5 Baht |

| More than 100,000 - 500,000 Baht | 10 Baht | Transfer via K PLUS |

| Not over 500,000 Baht | No fee | Transfer via K BIZ |

| Not over 500,000 Baht | No fee |