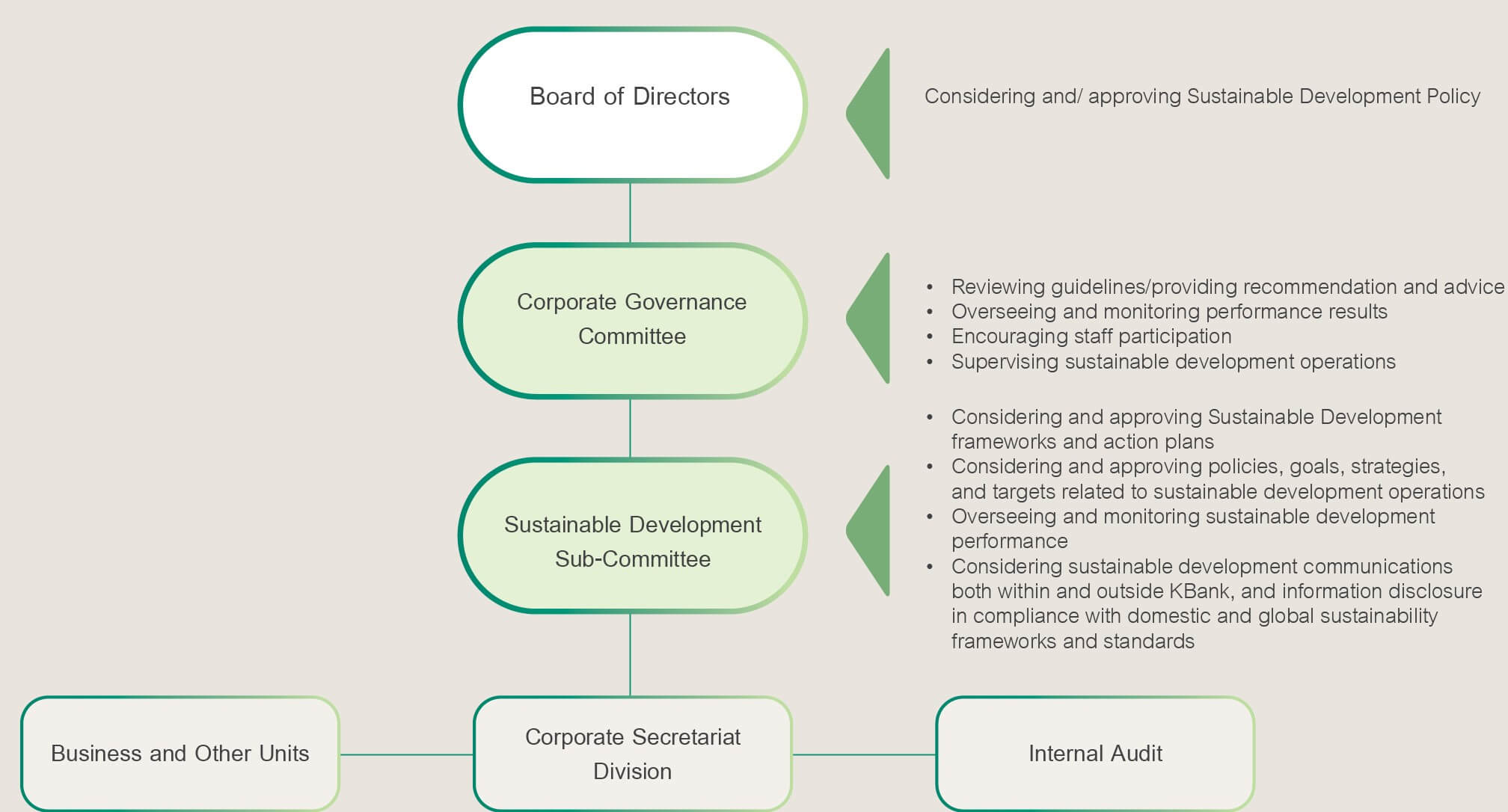

Sustainable Development Structure

KBank has assigned the Corporate Governance Committee to supervise sustainable development operations; the Committee holds at least four meetings a year to determine operational guidelines, monitor and report to the Board of Directors.

We established the Sustainable Development Sub-committee, chaired by the Chief Executive Officer, to be responsible for driving environmental, social, and governance operations as guided by the Sustainable Development Policy framework. Our mission is to establish a Sustainable Development framework and action plans, as well as overseeing, monitoring and assessing sustainable development performance.

Meanwhile, the Corporate Sustainability Integration Department of the Corporate Secretariat Division provides support for and collaborates with the Sustainable Development Working Group, which comprises representatives of KBank departments, and pursues the Board of Directors’ instructions to ensure consistency within all operational processes, thus leading to the achievement of targets and responding to stakeholders’ needs.